4 Easy Facts About Feie Calculator Shown

Table of ContentsFacts About Feie Calculator UncoveredFacts About Feie Calculator UncoveredMore About Feie CalculatorThe Feie Calculator IdeasFeie Calculator - The FactsThe Ultimate Guide To Feie CalculatorGet This Report on Feie Calculator

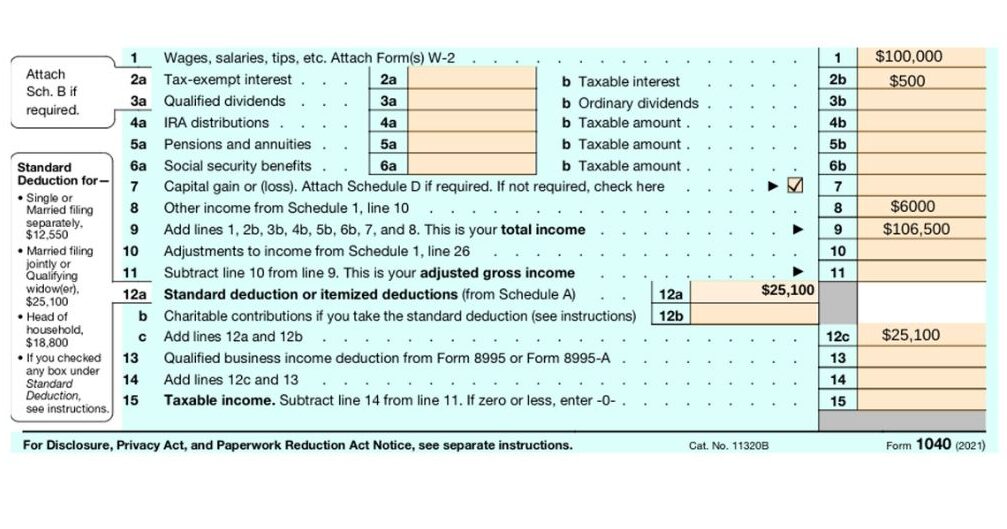

If he 'd regularly taken a trip, he would rather finish Part III, providing the 12-month duration he satisfied the Physical Visibility Test and his traveling history. Action 3: Reporting Foreign Revenue (Component IV): Mark made 4,500 per month (54,000 each year).Mark computes the currency exchange rate (e.g., 1 EUR = 1.10 USD) and converts his income (54,000 1.10 = $59,400). Because he lived in Germany all year, the percentage of time he lived abroad throughout the tax obligation is 100% and he enters $59,400 as his FEIE. Mark reports total incomes on his Kind 1040 and enters the FEIE as a negative amount on Schedule 1, Line 8d, reducing his taxable revenue.

Choosing the FEIE when it's not the most effective alternative: The FEIE might not be ideal if you have a high unearned income, earn even more than the exemption restriction, or stay in a high-tax nation where the Foreign Tax Obligation Debt (FTC) may be extra useful. The Foreign Tax Credit (FTC) is a tax decrease technique often made use of along with the FEIE.

The Buzz on Feie Calculator

deportees to counter their U.S. tax obligation financial debt with foreign revenue tax obligations paid on a dollar-for-dollar reduction basis. This implies that in high-tax nations, the FTC can typically eliminate united state tax debt completely. Nonetheless, the FTC has constraints on qualified tax obligations and the maximum case amount: Qualified taxes: Only earnings taxes (or taxes instead of earnings tax obligations) paid to foreign federal governments are qualified.

tax responsibility on your international earnings. If the international tax obligations you paid surpass this limitation, the excess international tax obligation can usually be continued for as much as 10 years or returned one year (via an amended return). Preserving precise documents of international earnings and tax obligations paid is therefore essential to computing the right FTC and preserving tax conformity.

migrants to decrease their tax obligation obligations. If a United state taxpayer has $250,000 in foreign-earned earnings, they can omit up to $130,000 utilizing the FEIE (2025 ). The remaining $120,000 may then be subject to taxation, yet the united state taxpayer can possibly use the Foreign Tax obligation Credit report to balance out the tax obligations paid to the foreign country.

See This Report on Feie Calculator

He sold his U.S. home to develop his intent to live abroad completely and used for a Mexican residency visa with his spouse to assist meet the Bona Fide Residency Examination. Neil points out that purchasing residential property abroad can be testing without first experiencing the location.

"It's something that people need to be really diligent regarding," he states, and suggests expats to be careful of usual mistakes, such as overstaying in the United state

Neil is careful to stress to Tension tax authorities tax obligation "I'm not conducting any business any kind of Illinois. The United state is one of the few nations that taxes its residents regardless of where they live, suggesting that also if an expat has no income from U.S.

The Basic Principles Of Feie Calculator

tax returnTax obligation "The Foreign Tax Credit scores allows people functioning in high-tax countries like the UK to counter their U.S. tax obligation by the quantity they've already paid in taxes abroad," says Lewis.

The prospect of reduced living expenses can be appealing, however it typically comes with compromises that aren't quickly evident - https://anyflip.com/homepage/taqqj#About. Real estate, as an example, can be more economical in click site some countries, yet this can suggest endangering on infrastructure, security, or accessibility to reputable utilities and solutions. Low-cost properties could be found in areas with irregular internet, minimal public transport, or unreliable medical care facilitiesfactors that can substantially influence your everyday life

Below are a few of one of the most regularly asked questions regarding the FEIE and various other exclusions The Foreign Earned Earnings Exclusion (FEIE) enables U.S. taxpayers to omit up to $130,000 of foreign-earned revenue from federal earnings tax, reducing their united state tax obligation responsibility. To get FEIE, you must meet either the Physical Visibility Test (330 days abroad) or the Bona Fide House Examination (verify your primary residence in a foreign country for a whole tax year).

The Physical Presence Test additionally requires U.S. taxpayers to have both an international revenue and a foreign tax obligation home.

Not known Details About Feie Calculator

An income tax treaty between the united state and an additional country can help stop double taxes. While the Foreign Earned Revenue Exemption reduces gross income, a treaty might supply extra benefits for eligible taxpayers abroad. FBAR (Foreign Savings Account Record) is a needed filing for U.S. citizens with over $10,000 in foreign financial accounts.

The international earned revenue exclusions, in some cases referred to as the Sec. 911 exemptions, omit tax obligation on wages earned from functioning abroad.

Excitement About Feie Calculator

The tax obligation benefit leaves out the income from tax at bottom tax obligation prices. Previously, the exclusions "came off the top" lowering revenue topic to tax obligation at the top tax prices.

These exemptions do not exempt the earnings from United States taxation but simply give a tax obligation decrease. Keep in mind that a bachelor working abroad for all of 2025 that gained concerning $145,000 without various other revenue will certainly have taxed revenue reduced to zero - properly the same answer as being "free of tax." The exclusions are calculated daily.

If you participated in service meetings or workshops in the US while living abroad, income for those days can not be omitted. For US tax obligation it does not matter where you keep your funds - you are taxable on your worldwide income as a United States individual.

Comments on “5 Simple Techniques For Feie Calculator”